26th Annual Directional Drilling Survey

- Peter Melsheimer

- Jul 23, 2024

- 7 min read

Blog written by Robert Carpenter and credited to Underground Construction. Link to original article here

You can also hear Robert Carpenter explain the HDD Survey on the Subsurface Stories podcast: HDD Survey Part 1; HDD Survey Part 2

In 2024, the drive to install fiber optic cable to homes, businesses and entire communities continues to ride the tidal wave of momentum. Already well-funded by private ventures and industry giants (i.e., AT&T, Xfinity, Verizon among others), the love affair with fiber in America has further heated up the past two years, as billions in government money have been and still are being pumped into the market via the famous Infrastructure Act of 2021.

As the fiber market continues to burn bright, so does the utilization of horizontal directional drilling. The small rig market’s appetite and need for HDD is again demonstrating remarkable consistency in 2024 according to the exclusive results of the annual Underground Infrastructure HDD Survey.

“We had an amazing 2023 and it looks like 2024 will be even better,” said a respondent from the Southwest. “Of course, that is assuming we can continue to keep up with our workforce needs. It’s been a struggle, but definitely getting better.”

For more than 26 years, Underground Infrastructure has been conducting its research into the disruptive technology of HDD and its impacts upon the utility and pipeline markets. To say HDD has been a game changer would be an understatement.

In addition to the continued strong fiber work, which primarily impacts small rig operations, other market twists are expected to further impact HDD markets in 2024 for all levels of rig operations.

This research effort was conducted during March and April 2024. It polled U.S. contractors that actively own and operate HDD units to enable a statistical portrayal of the market from small rigs to large and jumbo models.

Also included in the data results were assorted utilities that own and operate HDD equipment. That number has grown by 6 percent over the past year, further reflecting adaptation by utilities to highly volatile market conditions. That also illustrates the demand for HDD work in a market continuing to be short of personnel and equipment, forcing utilities to increasingly incorporate HDD in-house.

“In 2022, we started an ongoing replacement project in several areas where HDD was the perfect technology for the job conditions and needs,” said an electric utility construction manager in the Southeast. “We were having a tough time keeping contractors, as they had so much work and not enough people or equipment.

“Fortunately, we had the personnel and took the plunge to start doing a lot of the work ourselves. It took a while to get our equipment but, since then, it has worked out great and we now have two crews working fulltime installing distribution lines by HDD.”

Fueling the fire

Interestingly, in 2024 an already hot market is being kicked into overdrive with the much-anticipated Broadband Equity, Access and Deployment (BEAD) Program, a derivative funding mechanism from the Infrastructure Bill of 2021. BEAD will fund $42.5 billion for fiber installation to be spread over all 50 states, Puerto Rico and U.S. territories.

It is intended to be placed where broadband service is either completely absent or not as robust as it should be, typically in rural or low-income areas. For many contractors bidding on this additional work, 2024 through 2026 will be very hectic times, as the bulk of that funding hits the streets.

“We’ve finally gotten close to being caught up with our rig needs – we’ll see how long that lasts as we’re looking at replacing a couple of rigs later this year or early next. But we’re still struggling a bit with finding and retaining good help,” observed this contractor from the Midwest. “Both will be essential to our ability to perform all the work we’re lining up, including what we anticipate from the BEAD program.”

Rig manufacturing has overcome many of the market supply issues that wreaked havoc in recent years, with rig delivery delays ranging from several months to over a year in backlogs. Since 2021, frustrated manufacturers have tried everything imaginable to boost their supply chain and keep up with customer demand. Their contractor customers, in turn, have been desperate to find new or replacement rigs to keep up with demand from fiber utilities, which are also desperate to bring fiber products to a booming market place.

And it’s not just the rigs themselves that are requiring record levels of work by industry manufacturers. Various accessories such as mud systems, downhole tools, drill pipe, trackers, etc., have all combined with rig demand to force many manufacturers/supplies to add nightshifts, working around the clock to ensure constant delivery now that suppliers are close to catching up.

The good news is that the great small rig shortage that plagued the HDD market since COVID appears to be drifting to an end. The struggle for suppliers that could deliver ample materials on a steady basis severely inhibited manufacturing capability in 2021 and 2022. It was not uncommon for contractors to wait up to a year for several of the popular small rig models. Even industry giants Vermeer and Ditch Witch were desperate for parts to complete rigs and send them out factory doors.

However, by 2023 and now into 2024, manufacturers started seeing substantial relief from clogged distribution lines and parts have begun to flow at close to normal rates. Still, occasional hiccups plague the HDD industry, but those problems are receding back to minor issues rather than insurmountable problems. As one manufacturer explained, “We still have some concerns but that’s a whole lot better than having manufacturing being stopped dead in its tracks. Wait times are getting close to normal – what one would expect.”

Electric hardening

But both manufacturers and contractors are holding their breath in terms of keeping the supply of rigs/equipment on a steady track as the increase in power line spending may complicate the mix. Electric markets are now being supercharged by billions in supplemental Infrastructure Bill funds to “harden” their service lines.

Hardening refers to using various means and methods to strengthen or shore primarily overhead power lines from storms, flooding, tornadoes, hurricanes – even common accidents along highways and roads. Anecdotally in conversations with electric utility personnel, they all admit that the most practical way to harden electric lines is to move them underground.

But while that may seem like the simplest path, it is one of the most controversial. There remains an owner and engineer bias that moving electric lines underground is cost probative. Now, with federal dollars fueling electric work, more and more utilities are finally willing to consider undergrounding their systems and are finding success and working through the historical misconceptions regarding cost.

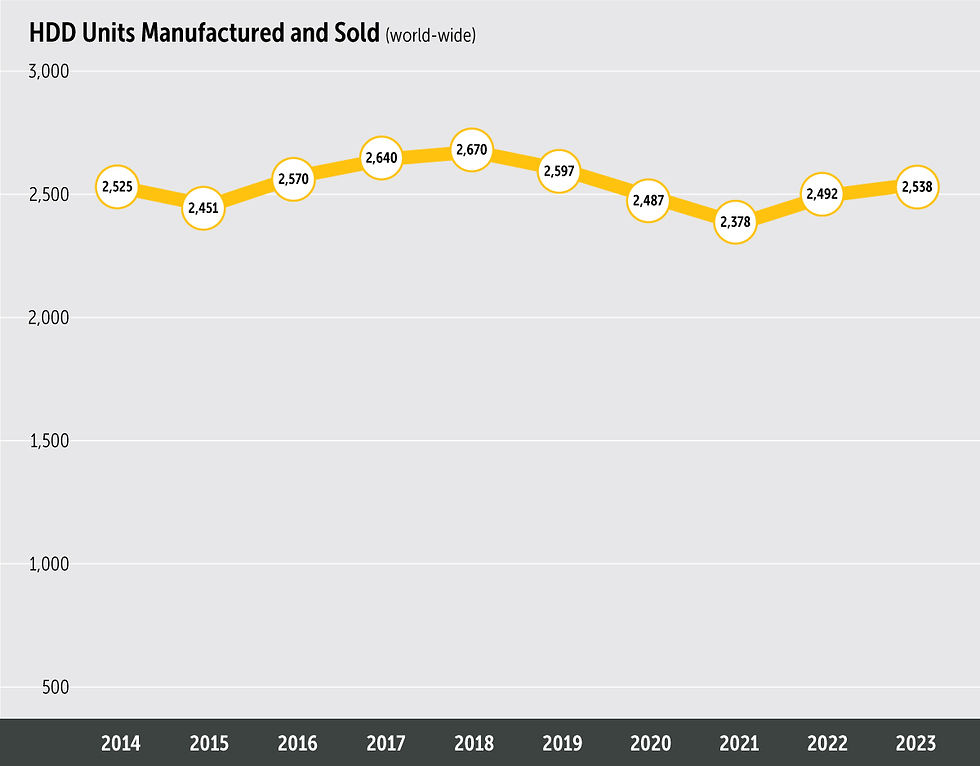

Overall, worldwide rig sales grew in 2023 to 2,528 and most expect 2024 to experience another jump, as rig manufacturers are now able to run close to full speed. The good news is that suppliers, in general, are doing a much better job in keeping up with demand, finally easing what have been crippling supply restrictions for all sizes of rigs.

In addition to fiber, other markets are displaying strong market strength, such as electric and gas distribution, water and even sewer applications. Frequently utilizing small rigs (40,000 pounds or less of pullback force), that sector should continue to account for 58.5 percent of all rig production in 2024. Rig manufacturing in mid-sized sizes (40,000 to 120,000 pounds of pullback) remains stable at 32.2 percent of the market. Jumbo rig sales (in excess of 1 million pounds of pullback force) retreated slightly from 1.1- to 1-percent market share.

Perhaps most notably, large rigs (generally 120,000 to 600,000 pounds of pullback force) have actually witnessed increasing sales in late 2023 and through the first half of 2024, after languishing in tough markets post-COVID. This is despite the incessant attacks and restrictions on conventional energy and pipelines by the President Biden administration that has vanquished many existing and planned pipeline projects, taking its toll on large rig contractors, who typically work in this market.

However, for the most part, large rig contractors have proven to be resilient and adaptable. The survey revealed that both contractors continue to diversify their work from prototypical oil and gas pipelines to all kinds of utility and even alternative energy projects. Large rigs seem to have found a sweet spot for those willing to stick their toes into the waters of diversification.

“We’ve seen definite strengthening of the large rig market,” reported a manufacturer. “Contractors are continuing to diversify successfully. We anticipate a good market in 2024.”

Water, water everywhere

One of the most common areas that large rig contractors are pursuing is water pipelines.

“In early 2023, we picked up a couple of good water projects to fill in the lack of oil and gas work,” related a Southwest contractor. “Our success on the projects has since opened the door for interest from other water utilities in our area and kept us busy. Working in the public works markets is a lot different than the private oil and gas market – we’ve had to do a lot of adapting and learning. But nonetheless, it has worked out well for us and we’ll probably keep doing this kind of work even if oil and gas come back strong.”

Water projects requiring larger rigs have grown significantly and that trend is projected to continue for the near future. Well-chronicled water pipeline problems and supply needs have forced municipalities to turn their attention to replacing and expanding their systems. Water utilities searching for additional supplies are both building and planning water pipelines. Add in billions of dollars to the Infrastructure Bill dedicated to water, and it’s easy to identify a robust growth curve for this market.

Contractors still are facing another familiar challenge in finding and retaining their workforce, though most feel like that has eased somewhat. “The last few years really hit us hard in terms of workforce,” said this Upper Midwest contractor, “We think we’re seeing a light at the end of the tunnel for 2024, as we’re getting better response to hiring practices.”.

“We’re still behind workers for what we’d like to have,” said this Mid-Atlantic contractor about his workforce. “But we’re finding some good people and slowly catching up to the point that we’re comfortable in buying some new equipment this year.”

A Westcoast contractor pointed out that “there have been several big company layoffs out here this past year that have worked to our advantage. We reached out to some of those people, hired and trained them, and now both of us are happy.”

The survey historically asks contractors about the most important characteristics and needs they seek from their manufacturer and supplier partners. Predictably, in 2023, availability of equipment was at the top of the list, as noted by 34.6 percent of the survey respondents. Service remained a strong desirable characteristic of vendors at 29.7 percent. Quality was third place at 20.2 percent.

Like any strong and growing market, HDD in general continues to have its fair share of problems, such as drillers without proper training or knowledge.

“We’re all for competition,” said this contractor from the Mountain West states. “But not being prepared to assume a role as a respectable and quality contractor is unforgivable,” he said. “This is a great industry, and we all need to do our part to keep it that way.”

Comments